What is an Agricultural (Ag) Exemption?

Are you envious of the neighbors because they have one and you don’t? You know, an agricultural exemption. Want to find out how to get an ag exemption on land in Texas? We can help you there. It will take a fair amount of time and some effort, but it’s not impossible. First, let’s cover what an ag exemption really is.

An “agriculture exemption” on land is not an exemption at all. It’s really just a “special valuation.” Property with this special (ag tax) valuation is still taxed, but in a different way. If a property has an agricultural valuation the appraisal district assigns the property an ag production value and a market value. Taxes get assessed each year based on the annual ag production value of the land, not the market value of the land.

This is why landowners such as yourself wonder how to get an ag exemption on land. The annual agricultural production value of land is significantly lower than the market value of land, hence the savings.

For lands with a “wildlife exemption” or wildlife tax valuation, land is taxed using the same annual ag production value that was used prior to the land being converting to wildlife management use. A wildlife tax valuation is a type of agricultural tax valuation, so the land must have an ag tax valuation the calendar year before it’s switched to wildlife management use.

What tax savings would I receive on property with an “Ag Exemption”?

The tax savings that a property receives varies. Annual savings depend on the current market value of the property and the type of ag valuation requested. Native pasture areas have a lower ag valuation than dry crop areas and both are much lower than the market value.

For example, an acre of native pasture in Central Texas has a market value of $10,000 per acre. The annual ag production value of native pasture is $130 per acre. The appraisal district assesses the ag land at a value of $130 per acre. At a 1.5% tax rate, the an annual tax is $1.95 per acre instead of $150 per acre. That saves the landowner about $148 per acre in taxes each year.

How do I Apply for Ag Exemption?

Let me tell you how to get an ag exemption on land in Texas. You engage in agricultural activities on your land and then you apply. Landowners may apply for ag valuation between January 1st and April 30th of the year in which they are seeking an ag valuation. Landowners can apply into June of each year but a late penalty applies.

In Texas, a tract of land must be in ag production for every 5 out of 7 years to maintain an ag appraisal. This is one of the sections on the applications. Fail this section and you’re out. In short, you need to engage in qualifying agricultural activities for at least 5 years if you have no history of ag production on your land.

Production Values for Ag Lands

How are production values set for agricultural properties, you ask? Cropland values are based on a five year average of typical income minus typical expenses using a share lease method. Pasture land values are based on typical income minus typical expenses using a cash lease method. These values will vary by county.

How many acres for an Ag Exemption?

How many acres do you need to qualify for an ag valuation? In Texas, each county appraisal district determines the minimum acreage needed to qualify for an agricultural tax valuation. Because of a diverse range of soil types in Texas, some parts of the state require more acreage than other areas to produce the same amount of product. Rainfall also varies greatly across the state and that impacts productivity.

In short, minimum acreages for an ag exemption/valuation vary across the state. There can also be different minimums within a county because of these ecoregion/soil differences. Some counties have no minimums, but most range from 10-50 acres.

Have a small property? Here’s how to get an ag exemption on land that’s not very big. Honey production is an ag use that requires only 5 acres of land. It takes installing some number of bee hives, but that sounds interesting and can establish ag production.

Activities that qualify for Ag Valuation

What types of activities qualify for ag use? There are many activities that may qualify your land for ag valuation and those can be found here.

- Cultivating the soil.

- Production of crops for human consumption, animal feed, or production of fibers.

- Cultivation of ornamentals and flowering plants.

- Cultivation of grapes.

- Cultivation of fruits, vegetables, flowers, herbs, and other plants.

- Raising livestock such as meat or dairy cattle, horses, goats, swine, poultry, and sheep.

- Raising exotic game for commercial use.

- Participation in a government program and normal crop rotation. Land left idle to participate in a government program is used for agriculture. Land left idle for crop rotation qualifies until left idle for longer than the typical period.

- Wildlife Management.

Things that do not qualify:

- Harvesting of native plants or wildlife.

- Processing of plants and animals.

- Processing constitutes any activities that take place after the crop or animal has been raised and harvested and any activity a non-producer carries out on agricultural products. Processing begins at the first level of trade beyond production. Processing begins when activities occur that enhance the value of primary agricultural products.

- Personal consumption of crops or livestock produced by owner.

- Land used to train, show, or race horses, or to ride horses for recreation, or to keep or use horses in some manner that is not strictly incidental to breeding or raising horses.

- Raising cattle, goats, or sheep for FFA and 4H projects.

- Token agricultural use which occurs in an effort to obtain tax relief

How Many Animals for an Ag Exemption?

There is a minimum number of animals required in addition to a minimum acreage size. So, how many animals do you need on a property to qualify for ag valuation? The number of animals needed for a property to qualify for ag valuation depends on location in the county, type of forage, and type of animal.

Refer to the county’s ag land qualification guidelines to find out how to get an ag exemption on land you own. Most counties in Texas have these ag guidelines available online and on their web site.

Wildlife Valuation: How do I Qualify?

In order to receive wildlife tax valuation the property must currently be under ag valuation. In addition a 5 year wildlife management plan must be submitted along with a new 1-D-1 ag application. There is no minimum acreage requirement for wildlife tax valuation unless the tract of land was reduced in size the year prior to application.

Ag Production Needed for Ag Exemption

A tract of land must be devoted principally to an agricultural use to maintain an ag exemption/valuation. If more than one use occurs on the land then the most important or primary use must be agricultural.

Some examples of non-qualifying primary uses are:

- Pleasure and/or personal use gardening.

- Exotic game primarily used for hunting.

- Land used primarily to train, show, or race horses, or to ride horses for recreation, or to keep or use horses in some manner that is not strictly incidental to breeding or raising horses.

How to Apply for an Ag Exemption

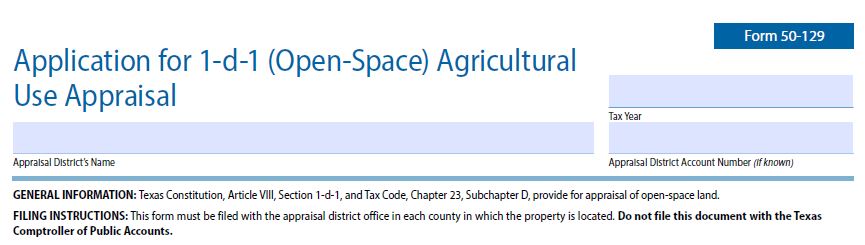

A property owner claiming that their land is eligible for special appraisal through agricultural use must file a valid 1-d-1 application with the appraisal district. The application must be filed before May 1st of each year. The 1-d-1 ag application must be filed with the chief appraiser of the appraisal district where the property is located. If the tract of land crosses county lines then an application must be filed with the appraisal district in each of the counties.

Property owners may obtain an application from the local appraisal office, the appraisal website, or the Texas Comptroller of Public Accounts website. If more time is needed, an extension to the deadline may be granted by the Chief Appraiser.

Late applications may be submitted after the April 30th deadline and up until the appraisal district’s appraisal rolls are approved by the appraisal review board (typically by mid-July). However, late applications which are approved will be assessed a 10% penalty for late filing.

Once the application is submitted to the appraisal district and approved, the land continues to receive an “ag exemption” (agriculture appraisal) until ownership of the land changes, the land’s eligibility changes, or the chief appraiser requests a new application.

History of “Ag Exemption” in Texas

In 1966 voters approved the first agricultural appraisal law for ad valorem (property) taxes in the State of Texas. This first law, known as 1-d, intended to protect the family farm from being taxed out of existence as Texas became more urbanized and market prices of agricultural land steadily rose.

Section 1-d is very restrictive as it applies only to land owned by families or individuals. Under 1-d, agriculture must be the owner’s primary occupation and primary source of income. Commercial ag operations did not know how to get an ag exemption on land, as they couldn’t. As Texas became more urbanized and the number of agricultural producers began to drop, a new section was added to the Texas Constitution by voters in 1978. Thank you big business.

The law was amended to allow a second, more liberal agricultural appraisal law known as 1-d-1. Section 1-d-1 substantially expanded eligibility for productivity appraisal by individuals as well as corporations. Income and primary occupation do not apply under 1-d-1. In 1996, wildlife management use was added as a subsection of 1-d-1 which allows the management of native species, using state guidelines, as a qualification for productivity value.

We specialize in developing management plans for Texas landowners interested in convert ag lands to wildlife management use. Please contact if you need recommendations for the management of your land.