How to Obtain a Wildlife Exemption in Collin County?

A wildlife exemption in Collin County is actually a special property tax valuation. It’s a valuation afforded to land that is actively managed for the conservation and habitat improvement of wildlife. This program is better referred to as a wildlife management use appraisal or wildlife exemption. It allows landowners to qualify for maintain a favorable property tax rate on land that is being used for wildlife management, rather than for agricultural or timber production.

Are You Eligible for Wildlife Exemption in Collin County?

The land must be actively managed for wildlife conservation. This includes efforts to protect and enhance the habitat for native wildlife species. So, you may be wondering how to qualify for wildlife management in Collin County, Texas? Common management practices include providing food, water, shelter, or maintaining native plant communities and habitat that benefits wildlife.

Landowners must manage for one or more native wildlife species. Aquatic and wetland wildlife can be targeted for management, but fish are not considered wildlife in this instance and can not be targeted for management for the purpose of a maintaining a wildlife tax exemption.

The property must have a current agricultural tax valuation in order to transition into a wildlife exemption, whether in Collin County or elsewhere in Texas. A wildlife tax appraisal is beneficial for landowners since the land is taxed at the same rate as if it were still being used principally for traditional agricultural production.

Developing a Wildlife Exemption Management Plan

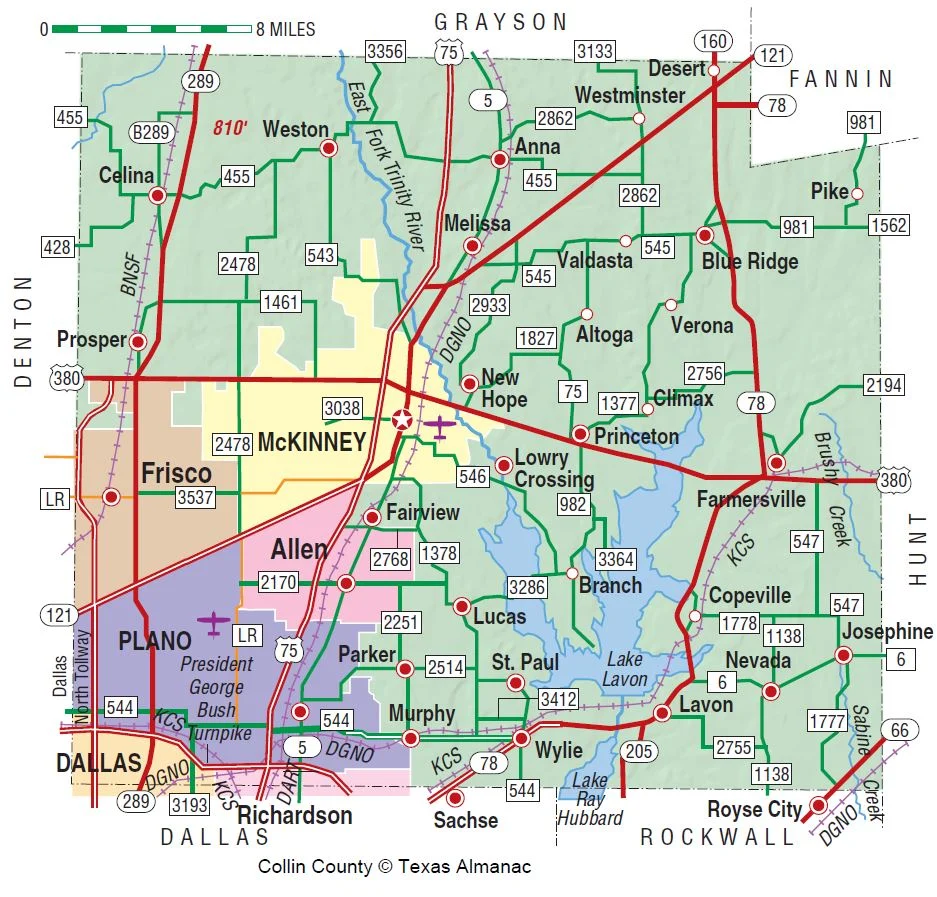

As part of the application process, you will need to provide the Collin County Appraisal District (CCAD) a wildlife management plan that outlines your activities for managing the land for wildlife. This plan must identify the wildlife that the landowner with target for management as well as outline the qualifying practices that we implemented on the land. The plan should demonstrate how you are actively managing the land for the specific wildlife species.

Landowners must submit completed wildlife management plans along with any supporting documents (such as the wildlife management plan and proof of eligibility) to the Collin County Appraisal District. You can find the necessary forms on the CCAD website or contact them directly. In addition, we assist landowners across Texas by developing wildlife management plans that meet their needs. Please contact us if you are interested in obtaining assistance with the preparation of your wildlife management plan.

Furthermore, landowners will need to submit an application for a wildlife management valuation (sometimes referred to as an “ag exemption”). This application is available through the Collin County Appraisal District (CCAD). The land being used for wildlife management use must meet minimum acreage requirements, if applicable. The minimum acreage requirement does apply to every property, and we can assist you with making this determination.

Maintaining a Wildlife Exemption in Collin County

The landowner must maintain the wildlife management practices and may need to submit annual reports to verify that the land is still being used for wildlife management. This is done by maintaining records of management actions, retaining receipts for items purchased, and taking photos. According to the Collin CAD, “Every property that is receiving the wildlife management appraisal will be mailed a Wildlife Management Annual Report for the property owner to fill out. This report will be to detail the actions that have been taken to implement the wildlife management plan during the year.”

In summary, the wildlife tax appraisal offers financial incentives for landowners who actively engage in wildlife conservation and habitat management on their property. Landowners that maintain a wildlife exemption in Collin County help promote wildlife conservation and biodiversity across the state, and maintain an agricultural tax valuation on their land. Please contact us if you are interested in converting your land to wildlife use.