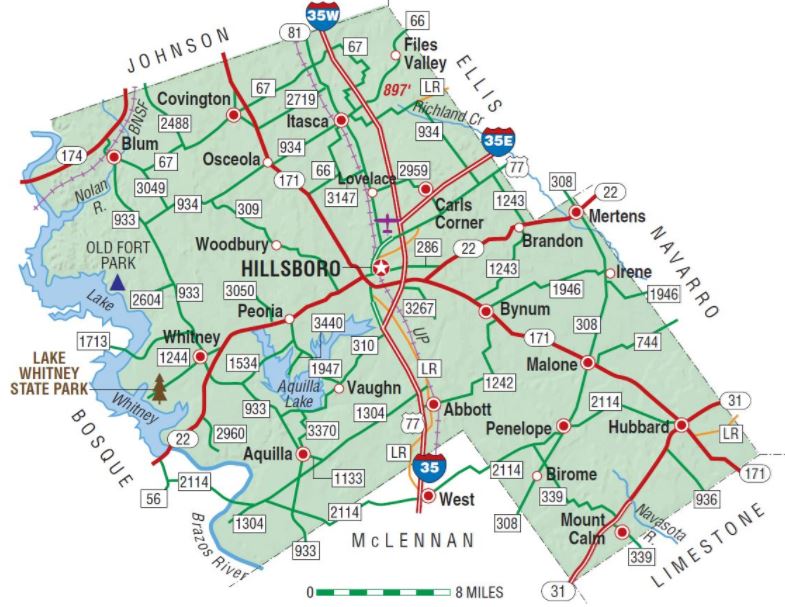

Hill County Property Owner: “We purchased property in west Hill County and want a wildlife exemption to manage for wildlife. The property has an ag taxes. The county appraisal district told me they require a wildlife management plan that outlines the wildlife we intend to manage for and the specific practices we will carry out.

Our property is 16 acres in size.What’s the next move? I’m still unsure of the application process. Found this site after searching the web since I did not want to call the appraisal district again. We are not wildlife pros by any means but want to take care of our land and file a plan that passes muster. Can you help us with a wildlife management plan in Hill County?

Switching to a Wildlife Exemption in Hill County

Thanks for reaching out to us! We have worked with property owners in Hill County in the past with great success. The process of applying for a wildlife exemption in Texas does not vary by county, but the local appraisal district does make the final decision within each of their counties.

We will send you additional information shortly. We do need more information regarding your land purchase, specifically how the tract size before and after purchase. This will help us in making a final determination on whether you can apply for a wildlife tax valuation in Hill County.

First Requirement of Wildlife Exemption – Wildlife Tax Valuation

Wildlife management is considered an agricultural use under the law. The first criterion of wildlife management use is that the land must currently be under agricultural use valuation to be eligible for wildlife management valuation. Texas Administrative Code Title 34, Part 1, Chapter 9, Subchapter G, Rule §9.2005 defines how to determine eligibility of land for wildlife management use. It states:

- A tract of land’s wildlife use requirement is a number expressed as a percentage and calculated by subtracting one from the total number of acres in the tract of land and dividing the result by the total number of acres in the tract of land. The following formula expresses the calculation, with “A” representing the tract of land’s total acreage: (A-1) ÷ A = R, wherein A is the total property size in acres and R is the ratio.

- If the number of acres in the tract of land is equal to or greater than the number of acres in the tract of land on January 1 of the preceding tax year, the tract of land is not subject to the wildlife use requirement.

- If the number of acres in the tract of land is fewer than the number of acres in the tract of land on January 1 of the preceding tax year, the wildlife use requirement the tract of land must meet to qualify for agricultural appraisal based on wildlife management use shall be 92% for the wildlife use appraisal region.

- The wildlife management use requirement that applies to a tract of land located in a wildlife management property association shall be 90.

Second Requirement for Hill County Wildlife Exemption

Second, the landowner must be actively using the land at the time the wildlife management begins. Simple land preservation does not qualify for wildlife management. The land can be appraised as qualified open-spaced land under a wildlife tax valuation if at least 3 of the approved 7 management practices are used to propagate a sustaining breeding, migrating, or wintering populations of indigenous wild animals for human use, including food, medicine, or recreation.

A wildlife management plan must be submitted to the Hill County Appraisal District in addition to your 1-d-1 Application for Agricultural Appraisal. The special use valuation per acre for wildlife management use maintains the same agricultural value as before its conversion to a wildlife exemption, wildlife tax valuation, In short, the annual taxes remain the same.