Madison County Property Owner: “We are interested in a wildlife exemption on our land. We have owned a 6 acre tract for over 30+ years that has an agricultural tax valuation. The property has been grazed with livestock in the past, as we lease to a neighboring landowner, but the fences are almost shot and as you can imagine we make very little income off of leasing 6 acres of grazing land.

We are not interested in continuing to lease our land and have no interest in raising livestock ourselves, since the fences are in need of major repair and we feel it’s not a feasible venture on such small acreage. We are interested in managing for wildlife, but do we meet the minimum acreage requirement for a wildlife exemption in Madison County?”

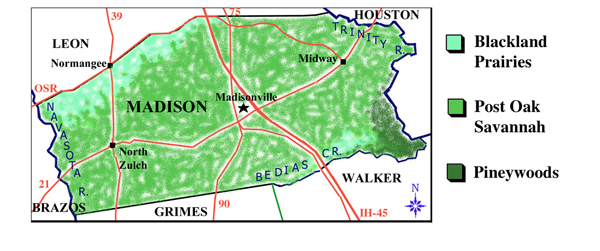

A Wildlife Tax Valuation in Madison County

Your situation in Madison County is actually quite common in other parts of Texas. It is not economically viable to attempt a commercial agricultural operation on small acreage because input costs take a long time to earn back. In fact, research conducted by Texas A&M University shows that in Texas, on average, it takes at least 150 acres for an ag property to break even.

That’s much more land than many rural land owners own, which means many are likely losing money on agricultural operations in order to maintain an ag tax valuation on their land. But you are on the right track; another alternative for maintaining an ag tax valuation on rural land in Madison County (and every other county in Texas) is through a wildlife tax valuation. It’s a great option for property owners interested in wildlife and wildlife habitat.

Can You Get a Wildlife Exemption?

The answer to your question is: Yes, your 6 acre property does meet the minimum acreage requirements for a wildlife “exemption.” Actually, because your property has been maintained an ag tax valuation and it has not been reduced in size it does NOT HAVE TO MEET the minimum acreage requirements. The only properties subject to the minimum acreage requirement in Madison County are those that have been reduced in size since January 1 of the prior tax year.

Your property consists of 6 acres, has maintained an ag tax valuation for decades, and has not been reduced in size, so you have the option to slide right into a wildlife tax valuation. You will have to file a wildlife management plan that describes how the property will be actively managed for wildlife, but we help property owners such as yourself with that all the time.

A Wildlife Management Plan for Madison CAD

A suitable wildlife management plan must outline at least one native wildlife species that will be managed for on the property, outline at least 3 management practices that meet the intensity requirements for the ecoregion and the size of the property, and be submitted along with a 1-d-1 application to the Madison County Appraisal District between January 1 and April 30 of next year. Let me know if you are interested in our wildlife management plan services and we will ask for additional information so that we can offer recommendations on how you can proceed.