Requirements for a Wildlife Tax Valuation

A wildlife tax valuation, commonly referred to as a wildlife exemption, allows Texas property owners to maintain an agriculture tax rate on their rural property while managing for native plants and animals. It’s a great deal for property owners and wildlife, but maintaining a tract of land under wildlife management takes more than a desire to enroll.

The majority of landowners are neither familiar with the requirements for the tax valuation nor developing a wildlife management plan that outlines specific objectives that will be implemented to maintain a wildlife tax valuation or reach property-based goals, but we are here to help.

Texas Landowners Must Apply for Wildlife Exemption

In Texas, to apply for property tax appraisal on lands maintained under an open spaced lands as authorized by Section 1-d-1 of the Texas Constitution, including appraisal of agricultural lands, timber lands, or land used for wildlife management, a property owner must file the proper documentation with the County Appraisal District on or before April 30 in the tax year that a wildlife exemption is desired.

Only properties that currently maintain an agriculture (ag) tax valuation or timber lands valuation may convert to an appraisal based on wildlife management use. Texas landowners that apply for wildlife management appraisal must provide an open space land application and a wildlife management plan to the county appraisal district.

Minimum Acreage Requirements for Wildlife Tax Exemption

Landowners often ask, “Is there a minimum acreage requirement for a wildlife tax valuation?” Correct answers include both “yes” and “no.” It depends. There is no minimum acreage requirement for tracts of land that have not changed in size since the prior tax year, but yes there is a minimum tract size for tracts of land that have changed in size (decreased) since the previous calendar year.

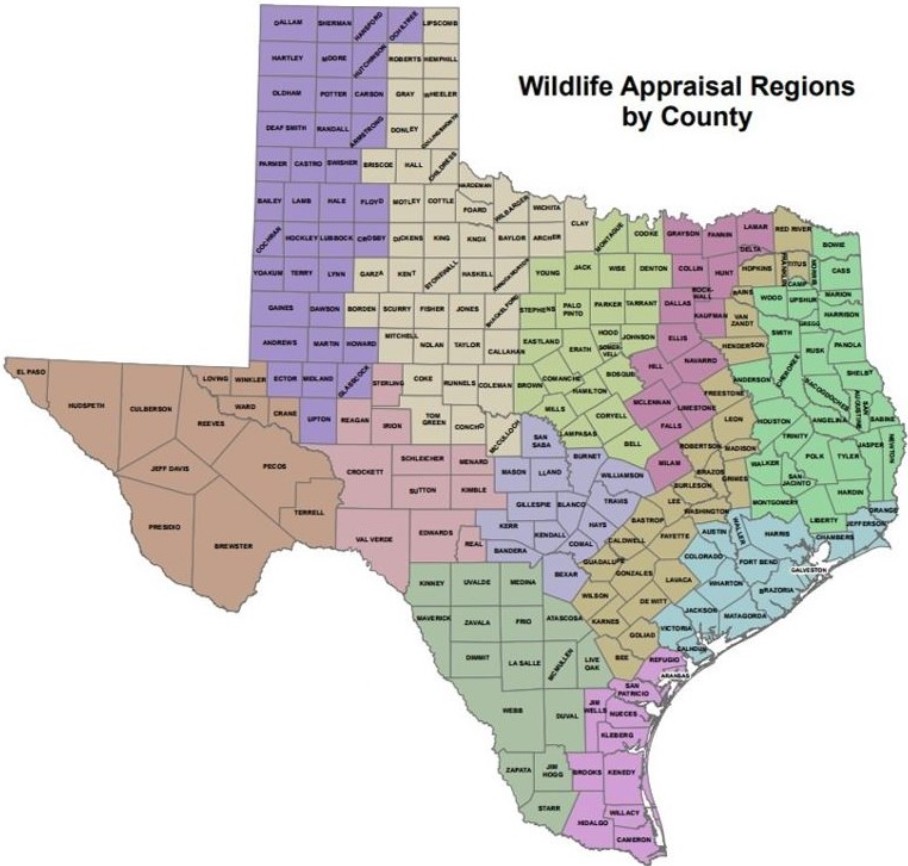

Under the first scenario, where a property has not changed in size, there is absolutely no minimum size requirement for a tract of land. In the second scenario, each county appraisal district can set a minimum acreage requirement for wildlife exemption based on the guidelines established by the State of Texas. In short, the minimum acreage size for a wildlife exemption varies by appraisal region and county, but the minimum acreage requirement only comes into play when a tract of land has been reduced in size.

For properties that have been reduced in acreage since the prior tax year, the minimum acreage requirement ranges from 12 to 50 acres, for the most part increasing in minimum size from east to west across Texas. If you are unsure whether or not your property meets the wildlife exemption requirements in your county, do not hesitate to contact us. We will be happy to get an answer for you.

Can Adjacent Tracts Qualify for a Wildlife Exemption?

It is important to point out that tracts of land that are adjacent and under the same ownership qualify as a single tract of land for the purpose of a wildlife tax valuation. It does not matter if the tracts are separated by road or water for the purpose of a wildlife exemption. However, even when tracts are under common ownership the adjacent, combined tracts (are treated as a single tract and) are subjective to the minimum acreage requirement, if applicable.

Bottom Line on Wildlife Exemption Requirements

- Land must have ag tax valuation

- Must file an application

- Must submit wildlife management plan

- Plan must outline objectives, qualifying practices

- No minimum acreage requirement, unless tract reduced in size